Want to know the real reason most entrepreneurs still feel trapped despite their success? It comes down to subtle money habits that quietly hold you back.

Through my own journey and conversations with other entrepreneurs, I’ve learned that breaking free from these subtle money habits can unlock true financial freedom.

These seven common patterns often go unnoticed, but once addressed, they can help you build lasting wealth and independence. Let’s dive in.

1. Stop Overpaying for Success

Think those “essential” business expenses are really essential? Here's a reality check from my 2023 experience.

I was paying $250 monthly for a CPA, $500 for legal services I never used, and $300–500 for stock photo subscriptions.

Why?

Because successful entrepreneurs had these services, so I thought I needed them too. Truth hit when my main revenue stream dried up.

Suddenly, I had to look at every expense, and guess what? Most of these “must-have” services weren't driving any real growth.

Split your income into 50% essentials, 30% wants, and 20% savings. It's a helpful guide, not a strict budget.

The goal? Save and invest more than you spend.

Start tracking your expenses for a month. You might be surprised by what's eating your money.

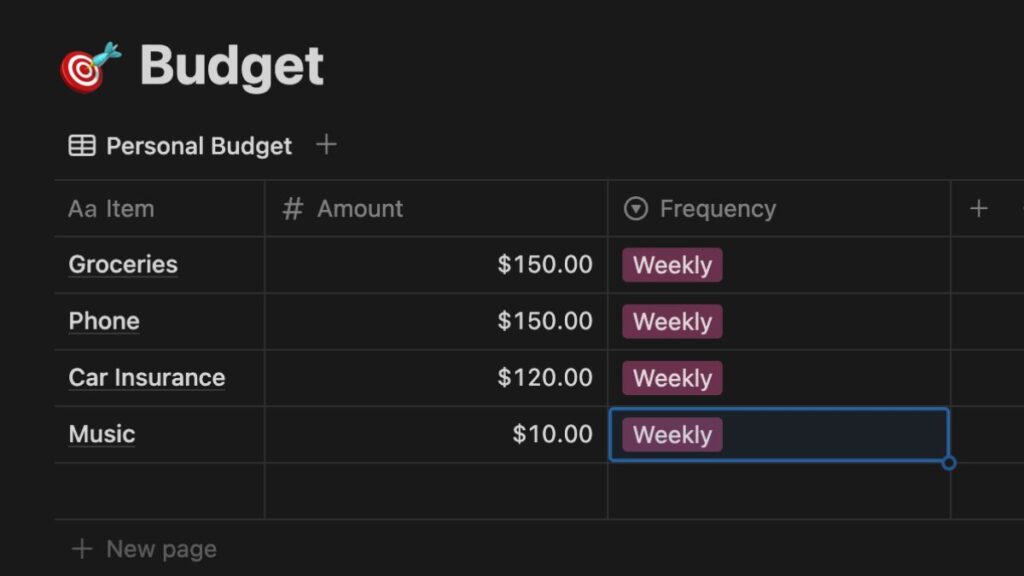

I keep it simple by using a Notion database listing all my subscriptions and reviewing them monthly.

2. Avoiding All Risk in Investing

Most entrepreneurs sabotage their growth by reinvesting every single penny back into their business, leaving zero financial cushion for themselves. Sure, it sounds smart.

After all, where else will you get better returns? But what happens when things change or you need to step away?

Keep it simple:

- Invest $100/month in a low-cost index fund.

- Stick to strategies you understand.

- Avoid timing the market.

- Focus on being consistent.

No need for fancy trading strategies or perfect timing. Just get started and stay consistent. That beats waiting for the “perfect” moment every time.

Instead of following the crowd, invest your money only in things you understand. Learn about different investing strategies and take time to build your knowledge.

3. Putting Off Financial Education

Ever catch yourself saying you'll learn about investing “someday”?

I used to think being good at math meant I didn’t need a budget. I paid off credit card debt as it came, assuming I had it under control.

But that ‘someday' mindset cost me opportunities until I reviewed my cash flow and realized how much I’d been overlooking. That wake-up call pushed me to dive into personal finance books and completely rethink my habits.

The good news is, just 30 minutes a week can change how you build wealth. Listen to finance podcasts during your commute or grab a good book.

Here are some books that helped me:

- The Psychology of Money by Morgan Housel.

- The Millionaire Next Door by Thomas J. Stanley.

- The Little Book of Common Sense Investing by John C. Bogle.

Focus on learning enough to spot opportunities and dodge expensive pitfalls. We're not trying to become Wall Street pros here. Just smart enough to make good money moves and know when to get help.

4. Letting Lifestyle Creep Take Over

Success hits different when it comes to spending. That new car or fancy office feels like a reward you've earned.

I learned this one the hard way. A few years ago I withdrew my $5K retirement savings early, lost half to tax penalties, and spent the rest on upgrades that didn't last.

Now? Extra money goes straight to retirement accounts or Bitcoin investments before I can think about upgrades. This wasn't an easy switch, but it's changed everything.

Try this: when your income jumps, decide upfront where it goes. Maybe 25% for lifestyle upgrades; invest the rest.

You can still enjoy life while building wealth and your future you will be thankful.

5. Relying on One Source of Income

Want to know what's scary? Relying on just one income source.

I learned this in 2023. After seven years hustling online, I finally hit success with a promising revenue stream.

Got excited, built a team, took on expenses. Then the publisher cut access without warning.

Just like that, my main income was gone. I had expenses, a team to support, and no backup plan.

Start small. Focus on one extra income stream at a time. Maybe digital products, dividend stocks, or real estate.

Think of each stream like planting a seed. Some grow fast, others slow, but together they build a solid foundation for success.

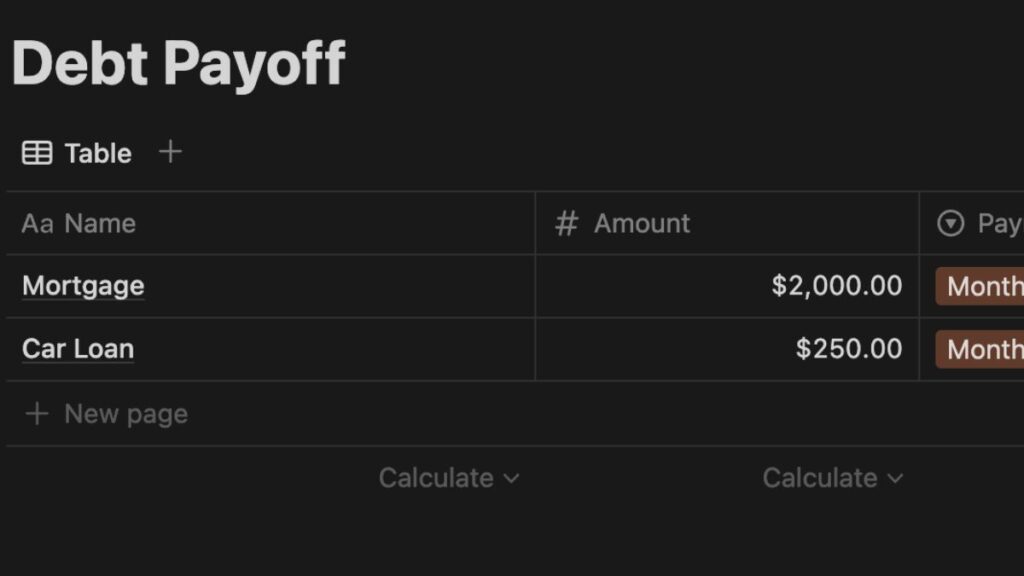

6. Ignoring High-Interest Debt

High-interest debt drains your wealth. Sure, some debt helps businesses grow, but those high-interest balances? They're just eating your future wealth.

Try this:

- List your debts by interest rate.

- Attack the highest rate first.

- Make minimum payments on the rest.

Consolidate if you can get lower rates, but don't use that as an excuse to rack up more debt.

Minimum payments keep you stuck. Even small extra payments cut your total interest big time.

Want real wealth? Break free from that high-interest trap.

7. Skipping Goal Setting

Without clear financial goals, you're just moving money around without direction.

SMART goals turn vague dreams into actionable results.

Skip the vague “I want to be wealthy” stuff:

- Be Specific: “Build a $100K portfolio.”

- Make it Measurable: Track progress monthly.

- Keep it Realistic: Start with $500 monthly.

- Tie it to a Timeline: Reach the goal in three years.

This approach helped me invest $200K through automatic transfers these past few years. I started with a few hundred monthly and watched it grow through compound interest and smart diversification.

Small steps lead to big results when you stay consistent.

Check progress monthly, and adjust when needed.

Plans change as you learn. Just keep your direction clear while staying flexible enough to adapt.

Your Financial Freedom Awaits

Breaking old money habits isn't just about following rules. You've built a successful business, but certain patterns might still keep you feeling trapped.

Imagine your wealth working for you, not the other way around.

Start with one habit today. Maybe it's tracking expenses or setting up that first automated investment. You've proven you can build success.

Now, take that first step. Your future self will thank you.

Chris helps entrepreneurs build wealth while prioritizing their freedom. Through over a hundred conversations on the Financially Well Off podcast, he’s uncovering what truly works to create balance, income, and independence. He shares weekly strategies to help you build a life where you can live well and work less.